Problems often start with seemingly routine signals: a query from a payment provider, a letter from a regulator requesting months of data, or a notice of a fine. From there, events escalate quickly—accounts are temporarily frozen, marketing campaigns are put on hold, partners grow uneasy, and a licence that once felt secure is suddenly called into question.

Using recent cases and official guidance, this article breaks down the specific operational failures that trigger sanctions and provides a roadmap for maintaining a resilient compliance framework.

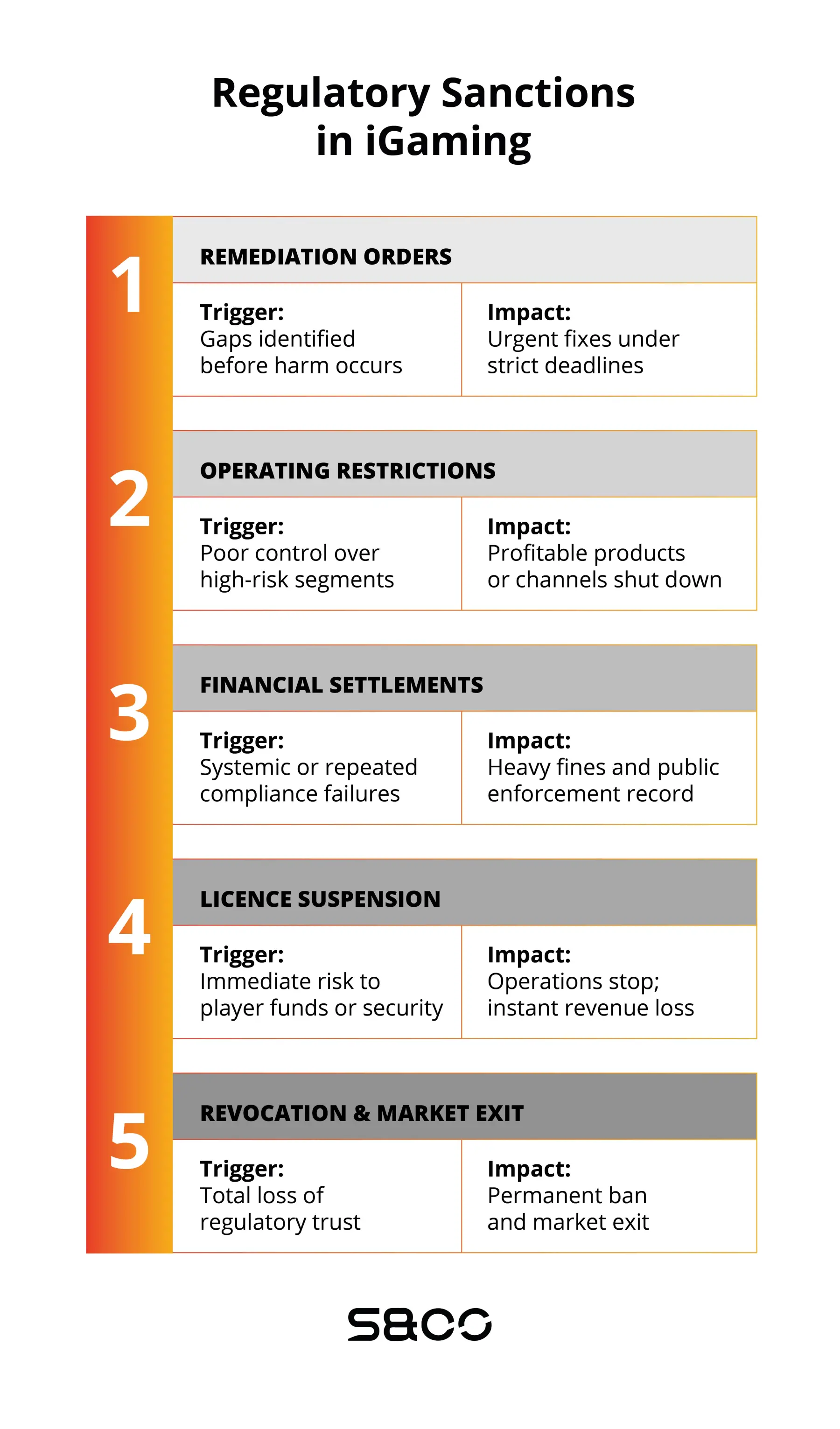

Types of sanctions in iGaming: what regulators actually use

iGaming regulators rarely move straight to licence revocation. In most cases, enforcement escalates step by step, depending on the severity, duration, and impact of the breach.

Even “mild” sanctions have real commercial impact: blocked payment providers, terminated affiliate relationships, loss of market access, and public enforcement notices that stay online for years.

In the next sections, we break down the specific compliance failures that most often lead to these sanctions, with real regulatory examples from different jurisdictions.

AML & KYC failures

Most AML breaches in iGaming are about weak controls: incomplete KYC, late source-of-funds checks, poor transaction monitoring, or no real risk assessment. From a regulator’s point of view, this means the operator does not understand or control how money moves through the platform.

For example, in October 2025, Platinum Gaming Limited, operator of Unibet in the UK, was fined £10 million by the UK Gambling Commission for serious AML and social responsibility failings. The regulator found that customers repeatedly breached loss limits and other risk indicators, yet required compliance actions were not taken in line with the operator’s own controls.

The Commission concluded that the company’s risk assessment and due-diligence framework was not applied consistently, including failures to factor in customers previously closed for AML reasons.

Regulators use an operator’s internal triggers as a mandatory benchmark for compliance. Detecting a risk signal without triggering the mandated "Hard Stop" or "Enhanced Due Diligence" (EDD) is viewed as a willful breach. This violation is penalized regardless of whether the operator intended to break the rules.

Safer-gambling failures

A breach happens when an operator detects risk but does not act, or acts too late.

Regulators treat this as a failure when:

- Loss limits, time limits or velocity thresholds are reached, but the account is not restricted, reviewed, or paused.

- Early risk signals after registration (fast losses, rapid deposits, long sessions) are not escalated.

- Repeated markers of harm appear over time, but customer interaction is delayed, superficial, or ineffective.

- Internal procedures exist on paper, but staff do not follow them consistently.

For example, in January 2024, the UK Gambling Commission fined Gamesys £6 million because clear player-risk signals appeared, but gambling continued. Customers showed rapid and sustained losses over short periods, yet accounts remained open and unrestricted. Loss patterns and spend levels triggered internal risk indicators, but no timely action followed.

Regulators now prioritize the effectiveness of an intervention over the mere existence of safety tools. It’s no longer enough to offer a "cool-off" button; operators must proactively stop players from spiraling. Automated risk alerts must be hard-linked to immediate account restrictions to be considered valid. If a system flags a "Marker of Harm" but allows play to continue, the regulator treats the intervention as non-existent.

Misleading or unlawful marketing and advertising

Marketing breaches arise from how, where, and to whom advertising is shown. Regulators assess the actual reach of an ad and the impression it creates, not the intention behind it.

A breach occurs when advertising reaches restricted audiences, appears in prohibited channels, or creates a misleading understanding of gambling. This includes both operator-owned campaigns and affiliate activity.

Regulators impose sanctions when:

- Ads are visible to minors due to weak or missing age-gating.

- Campaigns are not properly targeted, allowing broad or uncontrolled reach.

- Promotions suggest financial improvement, guaranteed wins, or reduced risk.

- Bonus terms are unclear, incomplete, or presented in a way that misleads.

- Marketing messages breach CAN-SPAM, GDPR, or CCPA requirements.

- Affiliates publish non-compliant ads and the operator fails to monitor or stop them.

In December 2025, the Kansspelautoriteit fined JOI Gaming Limited €400,000 for using role models in gambling advertising in breach of Dutch rules. During Jack’s Racing Day 2023, the operator’s promotional activity included well-known public figures signing branded merchandise and appearing with staff in branded clothing, with images published on the event’s website and social media.

The regulator determined that these activities constituted advertising for high-risk gambling products with role models, which is prohibited to protect vulnerable groups such as young adults and minors under the Dutch framework.

A different market, but the same regulatory logic applies when promotions distort player risk perception. In January 2023, the Ohio Casino Control Commission fined BetMGM $150,000 for promotional advertising that described betting offers as “risk-free”, despite customers being required to place real-money bets and meet wagering conditions.

The regulator concluded that the wording created a misleading impression of reduced financial risk, which is prohibited under Ohio law. As part of the enforcement action, BetMGM was ordered to remove or amend the advertising, and the decision was published as a public sanction.

Absolute honesty in marketing terminology is a legal requirement. Any promotion requiring a deposit or a wager cannot be labeled as free or risk-free.

Player funds protection failures

For regulators, player funds protection is about whether players can get their money back at any moment.

A breach occurs when player money is used, delayed, or put at risk, even temporarily.

Regulators impose sanctions when:

- Withdrawals are delayed without a valid reason or clear communication.

- Player balances are mixed with operational funds, exposing them to business or insolvency risk.

- Refunds are not processed after account closure, licence suspension, or market exit.

- The operator cannot demonstrate where player funds are held and how they are protected.

- Financial records are incomplete, outdated, or inconsistent with actual balances.

In January 2024, the Malta Gaming Authority cancelled the B2C gaming licence of Genesis Global Limited. This action followed an earlier suspension after Genesis entered insolvency proceedings in late 2022, laid off all staff, and ceased operations in Malta.

The licence cancellation meant Genesis could no longer offer gambling services under its Maltese permit covering multiple brands and 23 websites, including Vegasoo.com, Sloty.com, Casinojoy.com, Spinit.com and others. The MGA directed the operator to settle all outstanding fees, provide a complete transaction report with bank statements showing that all player funds had been returned to registered players, and remove any reference to the Malta licence from its sites - all within seven working days.

Insolvency does not exempt an operator from regulatory liability. Player funds must be kept in accounts that are legally isolated from operational debt. If a business ceases operations, regulators will demand proof of full repayment to players before the license is formally surrendered.

Technical and security failures

Technical breaches usually surface through incidents: leaked data, stuck withdrawals, duplicate payments, players accessing accounts they should not have access to. Once this happens, the discussion is no longer about documentation, it is about system integrity.

Regulators treat technical and security failures as breaches when:

- Player data or payment information is exposed, misrouted, or accessed without authorisation.

- Payment or wallet systems process transactions that should have been blocked, reversed, or paused.

- Platform logic allows gambling after self-exclusion, account closure, or limit breaches.

- Internal users can override safeguards without traceable approval or logging.

- Security incidents are detected late or reported after the fact, instead of immediately.

- Core systems depend on third-party providers without effective monitoring or fallback controls.

In 2025, Norway’s gambling regulator announced a NOK 36 million fine against Norsk Tipping after a technical fault in its iOS app prevented players from using self-exclusion and time-out tools for several months, meaning the operator’s critical safer-gambling control was inoperative.

Technical bugs are treated as regulatory negligence. An external software update is not an excuse for broken safety tools. Operators must maintain automated monitoring to detect immediately when self-exclusion rates or tool usage drop below expected levels.

Licensing and cooperation failures

A breach occurs when gambling activity takes place outside the scope of a valid iGaming licence or when the operator does not engage with the regulator once an issue is raised.

Once unauthorised activity or non-cooperation is established, outcomes often include market bans, licence revocation, public warnings, and domain blocking.

In the first half of 2024, Dirección General de Ordenación del Juego fined multiple unlicensed foreign online gambling operators for offering real-money gambling services without the required Spanish licence. Each of the 13 offshore operators was fined €5 million for very serious breaches of the Spanish Gambling Act and was banned from operating in Spain for two years. One operator received a higher fine of €10 million for repeat offences. The regulator also ordered the closure of their websites and enforced bans to stop them from targeting Spanish players without authorisation.

Corporate governance failures

Corporate governance problems arise when the regulator no longer understands who controls the business and how key decisions are made.

Typical governance problems regulators focus on include:

- Ownership or control changes that happen first and get reported later, or not reported at all.

- Shareholding structures that hide the real decision-makers or are not updated after restructurings, investments, or exits.

- Directors or senior managers stepping into roles without regulatory approval, where approval is required.

- Key individuals who fail fit & proper checks due to integrity issues, financial problems, or past regulatory breaches.

- Repeated delays, partial answers, or silence during regulatory information requests.

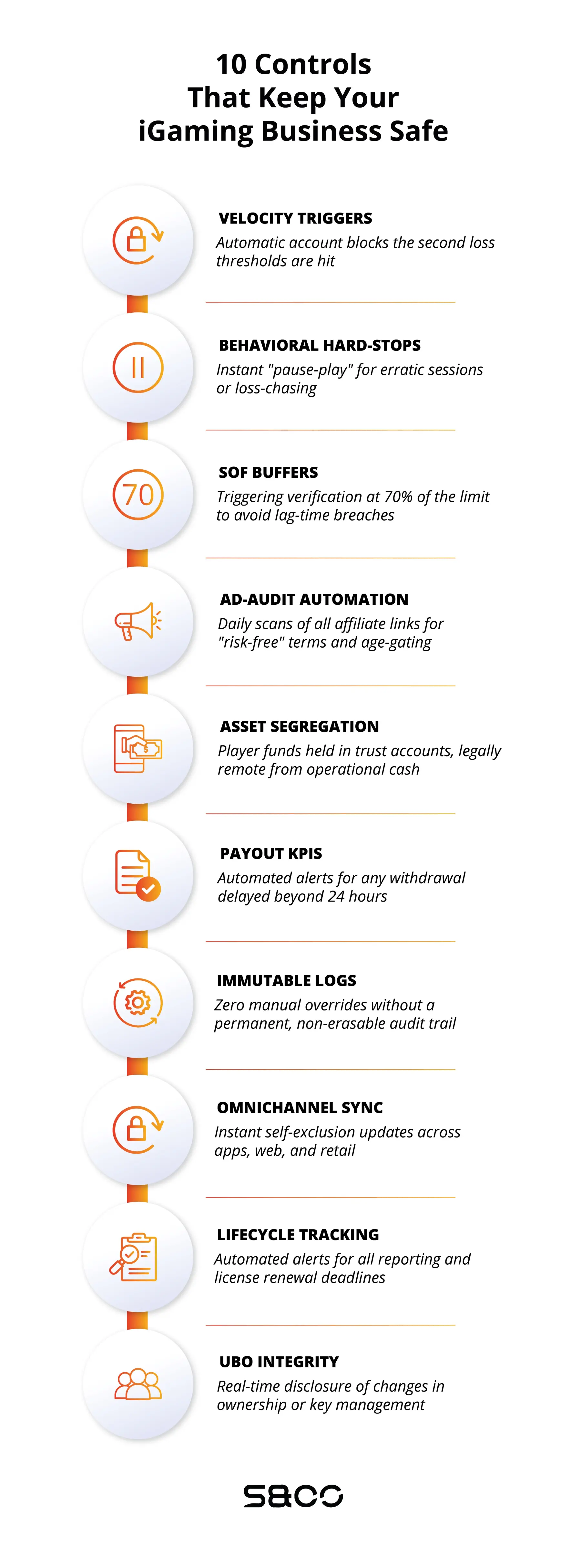

Ten practical steps operators should implement now

This checklist highlights the concrete controls operators should have in place today to reduce enforcement risk and keep their licence stable across markets.

Regulatory action in iGaming follows visible risk and delayed response.

Operators that act immediately on risk, keep controls working in practice, and maintain clear regulatory communication significantly reduce the likelihood of fines, suspensions, and licence loss.