If you’re launching an online casino or sportsbook in 2026, the biggest obstacle isn’t traffic, affiliates, or even platform development. It’s licensing. Without a proper gaming license, you can’t open a bank account, onboard a payment processor, sign with affiliates, or even run ads on most platforms.

Our lawyers created a step-by-step guide that explains how to get a gambling license with real numbers, compliance requirements, and mistakes that cost businesses time and money.

How to Select the Right Jurisdiction for Your iGaming Business

The jurisdiction you select dictates your ability to open bank accounts, onboard PSPs, and launch quickly. Regulators vary drastically in credibility, due-diligence standards, and technical obligations. Below are the core factors to evaluate before selecting a licensing country.

How Your Regulator Is Viewed by Banks and PSPs

Before anything else, assess how banks, PSPs, and major partners view the jurisdiction. Some regulators have long-standing credibility, others trigger additional checks or outright rejections.

- Malta, UK, Isle of Man: widely trusted by PSPs and acquirers due to strict audits, defined reporting systems, and transparent oversight.

- United States: highly reputable, but approval applies only to the specific state and requires full local compliance.

- Curaçao: flexible for global operations, but the transition to the new LOK may increase market restrictions in specific jurisdictions until the GCB's new regulatory regime is fully established and recognized.

- Estonia: operational and recognized, but may require more documentation during onboarding.

- Anjouan, Panama: limited acceptance among traditional PSPs; suitable mostly for crypto-only models.

Where Your License Actually Works

Each regulator defines where licensed operators can legally target players and what restrictions apply. Understanding this early prevents compliance issues later.

- UK: for UK-facing operators only; strict marketing and player protection rules.

- Malta: suitable for global markets except restricted jurisdictions; requires monthly reporting and AML oversight.

- Estonia: EU-recognized but requires a local entity and infrastructure.

- Curaçao: flexible for global operations, but some markets impose restrictions on Curaçao-licensed operators.

- US: licensing approval in one state does not permit operations in another.

How Long Your License Will Actually Take

Approval times vary significantly between jurisdictions. Timelines must match your launch plan and investment schedule.

- Malta: 6–12 months

- UK: 6+ months

- Isle of Man: 3–5 months

- Curaçao: 3–6 months

- Philippines: 3–6 months

What Your Finances Must Look Like

Regulators assess financial stability, source of funds, and the operator’s ability to support player balances.

- Malta: €100,000–€240,000 paid-up capital, depending on license type.

- UK: no fixed capital, but the strictest source-of-funds verification for shareholders and controllers.

- Isle of Man: requires proof of liquidity and segregation of player funds.

- Curaçao: introducing standardized capital and solvency requirements.

- Brazil: has fixed minimum capital requirements (BRL 30 million) and a financial guarantee (BRL 5 million).

How Strong Your Tech and AML Controls Must Be

More reputable jurisdictions impose stronger operational requirements. These obligations affect your platform architecture and internal processes.

- AML/CFT framework aligned with FATF standards

- Transaction monitoring systems

- RNG certification (GLI/BMM)

- Internal сontrol system documentation

- Regular compliance reporting and audits

- Appointed MLRO and approved key persons

How the Jurisdiction Fits Your Plans

No single jurisdiction suits every operator. The right choice depends on your product, payment methods, and growth plan.

- Crypto casinos: most compatible with Isle of Man and Curaçao.

- EU-focused sportsbooks: commonly licensed in Malta or Estonia.

- Fast-launch casino models: often choose Curaçao or Isle of Man for smoother onboarding.

- Companies seeking investment: typically favor Malta or Isle of Man due to higher regulatory credibility.

The regulator must support the model you plan to scale, not just issue a license.

Step-by-Step Licensing Process

Regulators apply strict checks at every stage of the licensing process. Here’s a clear look at the steps operators actually follow when applying for an online casino license or betting license.

1. Set Up Your Company Structure

Regulators want to see a clean and transparent company structure before they even look at the rest of your application. In practice, this means having the basics in place: the right legal entity, a clear ownership chart, proof of capital, and a separation between your gambling business and any other activities, like affiliates or marketing.

2. Prepare Your Compliance Package

Before regulators look at your platform, they need to see that your compliance framework is real, complete, and workable. This includes your AML and KYC procedures, risk assessment, responsible gaming policies, and the internal rules that describe how your system actually operates: from deposits and withdrawals to RNG, reporting, limits, and data storage.

3. Get Your Directors and Key Persons Approved

Regulators look closely at the people running the company. They check criminal records, financial history, past business activity, relevant experience, and the source of each director’s wealth. If someone in a key position can’t pass this “fit and proper” review, the application doesn’t move forward.

4. Complete Your Platform and System Audit

Most reputable jurisdictions won’t approve a license until your platform passes an independent technical audit by a certified testing lab like GLI or BMM. During this audit, the testers check how your system actually works: from the fairness of your RNG and the integrity of your games, to your wallet logic, reporting tools, anti-fraud setup, and responsible gaming features. They also look at system stability and data security to make sure everything holds up under real conditions.

5. Submit Your Licensing Application

Once your corporate structure, compliance documents, and technical audit are ready, you can submit your licensing application. At this stage, regulators expect a complete, consistent package.

6. Respond to Regulator Questions and Follow-Ups

Once your documentation, audits, and corporate records are in place, the regulator moves into the formal review stage. At this point, it’s normal to receive follow-up questions. They usually relate to your source of funds, AML procedures, technical setup, operating policies, ownership structure, or agreements with platform providers and PSPs.

7. Meet Your Ongoing Compliance Obligations

Getting the license is only the starting point. Once you’re approved, regulators expect you to maintain the same standards you showed during the application, and they actively monitor how you operate. This includes submitting regular reports, keeping your AML and responsible gaming procedures updated, and ensuring your platform continues to meet all technical and security requirements.

For example, in 2021, Malta’s regulator cancelled the licence of Smart Operations Ltd less than six weeks after granting it. The MGA found that the operator had failed to comply with its regulatory obligations and had not paid licence fees.

The takeaway is simple: treat compliance as a continuous, day-to-day responsibility. If you wait for the regulator to “remind” you of your obligations, it’s already too late. Staying proactive protects your licence and business.

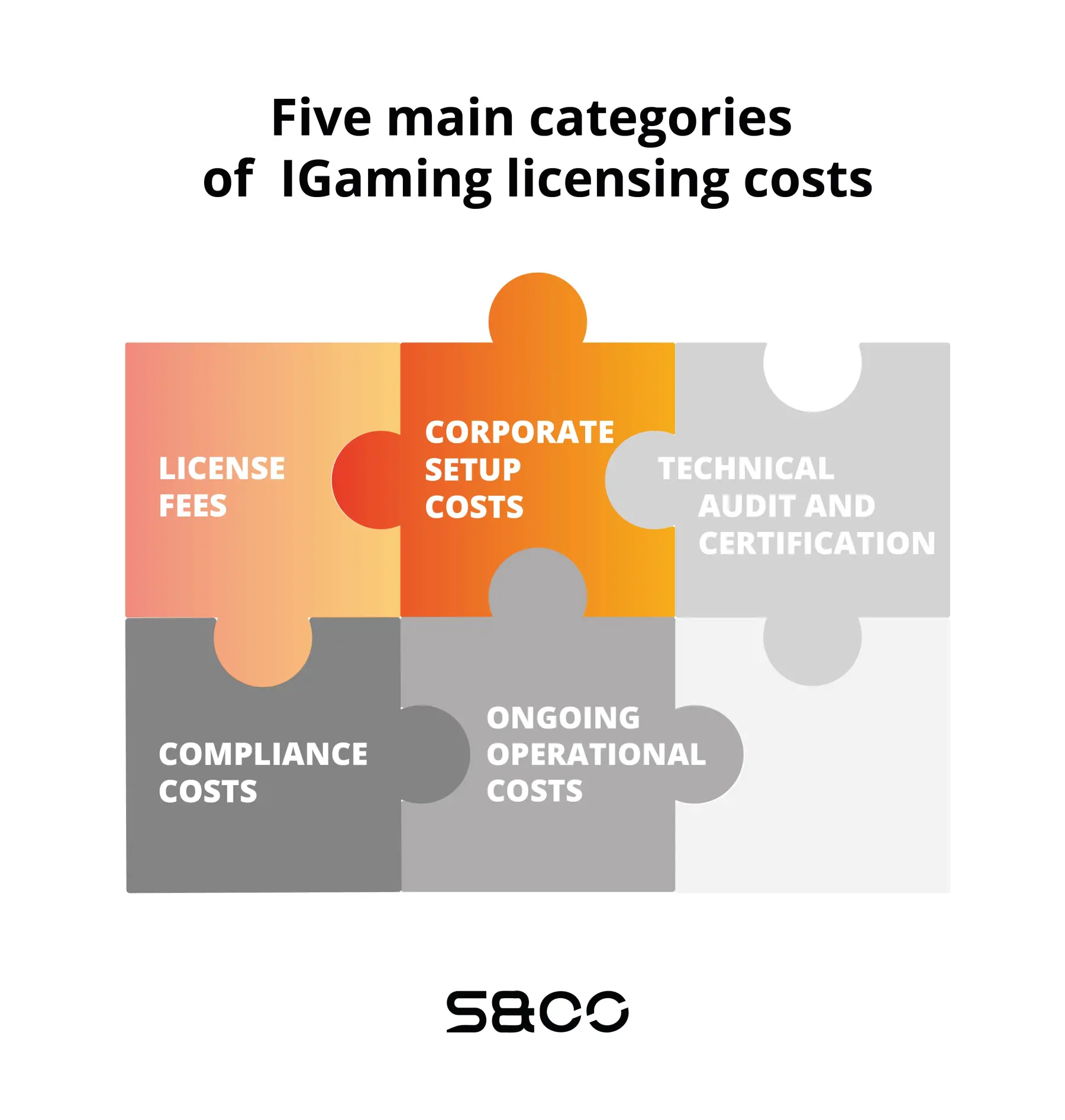

Costs and Timelines

The cost and duration of the licensing process depend on your jurisdiction, the complexity of your platform, and how prepared you are before submitting the application.

Here’s how the costs and requirements compare across major licensing hubs.

Malta

Malta remains one of the most respected and credible EU licensing jurisdictions for iGaming, and that credibility comes with strict requirements and longer timelines. This is not a “quick” license, it’s intended for operators who want strong regulatory backing and long-term stability.

- Estimated first-year cost: €170,000–€300,000

- Timeline: 6–12 months

What the money actually covers:

- Regulator fees

You’ll pay €5,000 just to open an application, and then €25,000–€35,000 per year to hold the license.

- Corporate setup

Setting up the local entity and the basic structure usually comes out to €5,000–€10,000.

- Technical audit

GLI or BMM will go through your platform line by line — this costs €15,000–€40,000 depending on how complex your setup is.

- Compliance

All the required AML/KYC documentation, ICS, risk assessments, responsible gaming tools and policies will cost roughly another €15,000–€40,000.

- Capital requirements

MGA expects real financial stability — most operators need €100,000–€240,000 in paid-up capital.

Malta works best for companies that plan to scale seriously and want a license that opens doors rather than raises questions. If your aim is “no friction” with PSPs, affiliates, and high-end partners, this is usually the jurisdiction they expect to see.

Isle of Man

- Estimated first-year cost: £80,000–£100,000

- Timeline: 3–5 months

What the money actually covers:

- Regulator fees

The main annual fee sits at £36,750.

- Corporate setup

Company formation and structuring typically costs £6,000–£10,000.

- Technical audit

A full system audit will usually be between £10,000 and £25,000.

- Compliance

Preparing AML/KYC frameworks, internal controls, reporting procedures, and responsible gaming tools adds £10,000–£20,000.

- Capital requirements

There’s no mandatory set capital, but the regulator expects you to show you can actually operate, meaning liquidity, solvency, and enough funding to cover player balances.

This jurisdiction appeals to operators who want Tier-1 reliability without going through the full complexity of the MGA process. If you need a stable, respected license and want predictable timelines, Isle of Man tends to deliver exactly that.

Curaçao

- Estimated first-year cost: $60,000–$100,000

- Timeline: 3–6 months

What the money actually covers:

- Regulator fees

$30,000–$50,000

- Corporate setup

Local registration and infrastructure setup include the mandatory requirement for local "Substance" and a physical presence on the island. This typically costs $10,000–$20,000.

- Technical audit

Testing RNG, reporting, game fairness, and platform stability typically costs $5,000–$15,000.

- Compliance

Preparing AML/KYC policies, internal controls, and reporting procedures costs around $5,000–$15,000.

- Capital requirements

You’ll need to show proof of sufficient liquidity/financial stability to cover player balances and operational liabilities, moving beyond basic financial sufficiency.

Curaçao makes the most sense for operators who want to launch quickly, keep early-stage costs under control, and still operate under a regulator that now has demonstrably stricter standards (GCB/LOK). It’s a practical option for casino-first businesses, including those with crypto-heavy traffic.

United States

The U.S. uses a state-by-state licensing model. There is no national license, and each state sets its own fees, approval requirements, partnership rules, audit requirements, and renewal conditions. Costs are higher than in most international jurisdictions, and the review process is considerably deeper, especially for ownership and source-of-funds checks.

For anyone researching how to obtain an online gambling license in the USA, New Jersey is one of the examples of what the fees and requirements actually look like.

- Estimated first-year cost: $800 000 – $1 500 000+

- Timeline: 6–18 months

What the money actually covers:

Regulator fees

- Internet Gaming Permit: $400,000

- Responsible Internet Gaming fee: $250,000 annually

Corporate setup

- U.S. entity requirements

- Mandatory partnership with a licensed land-based casino

Technical audit

- Full platform testing: wallet logic, reporting, game integrations, geolocation, RG tools

Compliance

- Deep background checks for all owners and key persons

- Source-of-funds verification

- AML/KYC and internal control documentation

Capital requirements

- No fixed minimum, but operators must demonstrate sufficient financial stability to support the business and meet high regulatory fees.

If you're considering the U.S. market, start with a clear budget and a realistic timeline. New Jersey shows how high the bar is. Plan your structure, partners, and compliance early to avoid delays and keep the licensing process predictable.

Brazil

Brazil uses a new federal regulatory framework (Law 14,790/2023) that imposes strict financial, technical, and compliance obligations. The federal government issues the license, but operators must still meet local requirements for payments, advertising, and corporate presence.

- Estimated first-year cost: $500,000–$1,000,000+

- Timeline: 3–8 months

What the money actually covers:

Regulator fees

- BRL 30 million (~USD 5.5–6.1 million) — the official licensing fee for a 5-year authorization.

- Monthly Supervisory Fee, calculated based on GGR volume (up to ~BRL 1.9 million/month for the largest operators).

Brazil currently has the highest raw licensing cost in the global iGaming market.

Corporate setup

Brazil requires:

- a local company registered in Brazil,

- at least 20% of the equity held by a local resident or Brazilian company,

- local officers/representatives,

- local payment flows, including mandatory support for PIX,

- tax registration and ongoing financial reporting.

This setup is more complex than Malta, Curaçao, Isle of Man, or Estonia.

Technical audit

Operators must undergo certification by approved labs, covering:

- RNG and game fairness

- geolocation

- wallet and transaction logic

- anti-fraud controls

- reporting formats

- responsible gaming features

Additionally, platforms must integrate with Brazil’s official government monitoring system and operate under a .bet.br domain, which is mandatory.

Compliance

The compliance burden in Brazil is among the strictest in the world. It includes:

- AML and KYC framework aligned with COAF

- mandatory CPF verification and biometric checks

- responsible gaming tools (limits, exclusion registers, alerts)

- advertising restrictions

- real-time reporting to the Ministry of Finance

- ongoing system monitoring

Capital requirements

Unlike most jurisdictions, Brazil has fixed statutory financial requirements:

- BRL 30 million paid-up capital

- BRL 5 million financial reserve as a guarantee

Brazil offers enormous market potential, but only for operators ready for the financial load, the technical integrations, and the strict compliance environment. The upside is significant, but the barrier to entry is higher than in any traditional iGaming jurisdiction.

Philippines

This jurisdiction is widely used by casino brands targeting the Philippine domestic market and is considered a practical, moderately priced, legally recognized option for iGaming.

The license for Offshore Gaming Operations (POGO/OGI), which targeted international players, has been significantly restricted or effectively eliminated by 2025. New licensing is primarily focused on Philippine Inland Gaming Operators (PIGO) serving the domestic market.

- Estimated first-year cost: $130,000–$200,000

- Timeline: 3–6 months

What the money actually covers:

Regulator fees

- Application fee: $10,000–$20,000

- Monthly license fee: based on Gross Gaming Revenue (typically 5% for domestic PIGO operations)

- Annual renewal fee varies depending on revenue tier

Corporate setup

- Local entity incorporation

- Local office requirement

- Local key-person appointments

Setup costs are higher than Curaçao but lower than Malta or the US.

Technical audit

- Certification for:

-

- RNG

- game fairness

- reporting

- wallet / transaction logic

- Integration with the PAGCOR-approved monitoring system

Compliance

- AML program aligned with the Philippines AMLC

- Reporting obligations

- Responsible gaming tools

- Ongoing audit requirements

Capital requirements

- PAGCOR requires a minimum paid-up capital (often ₱25 million, or ~$429,000+ depending on license type)

- Proof of liquidity and operational capabilities

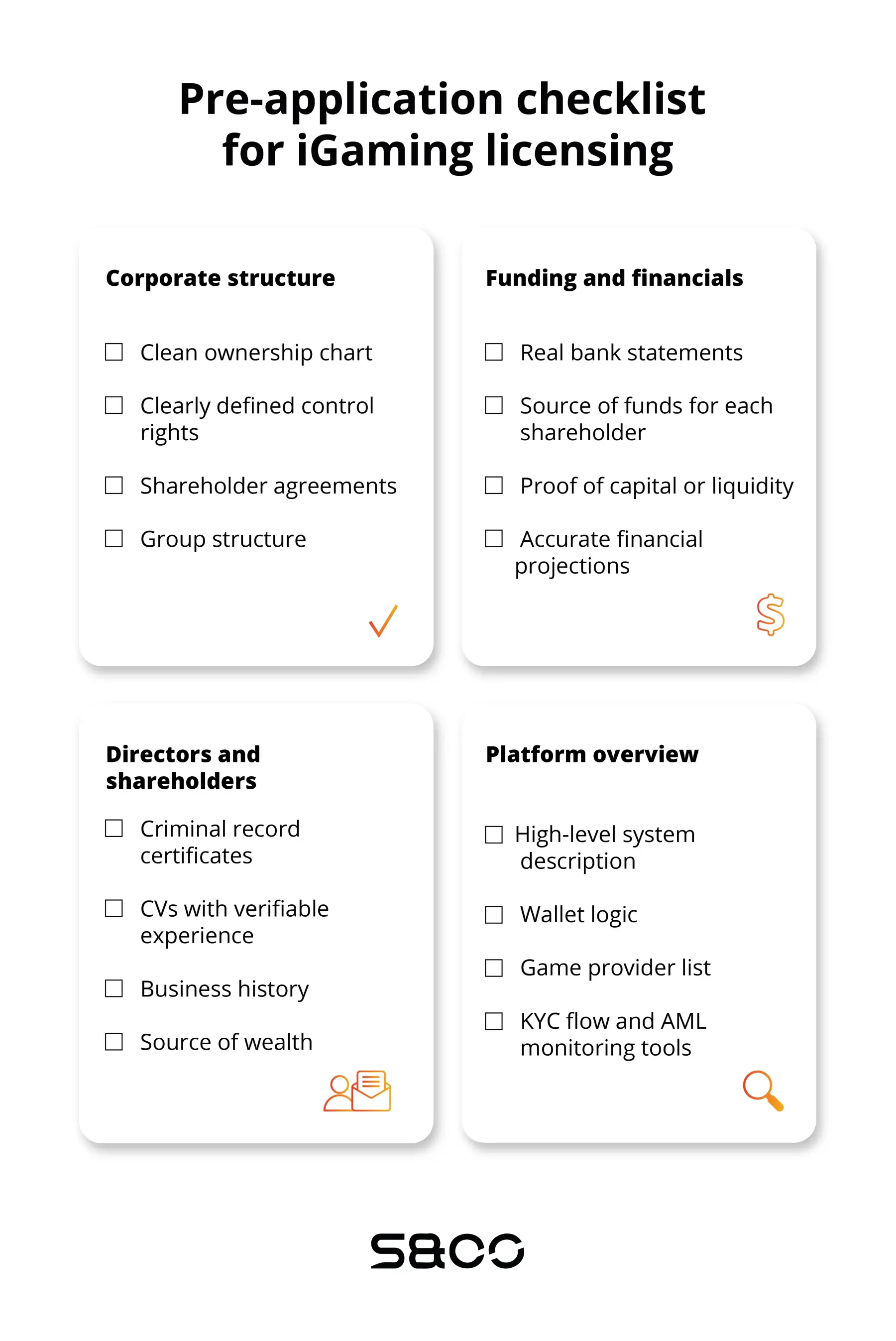

How to Prepare for a Successful Application

Here’s what you should have ready before you hit “submit”.

Every regulator has its own process, but the first three things they check are almost always the same:

1. Who owns the company

This is the most sensitive area. If the ownership chain looks complicated, offshore, or has unexplained gaps, the review becomes much stricter.

2. Where the money is coming from

Regulators verify that:

- shareholder funds are legitimate,

- there are no mismatches between income and declared wealth,

- investments are documented properly.

This is where most applications slow down.

3. Whether your internal controls exist in reality

They don’t just want a set of PDFs, they want policies that match your actual operations. If your AML policy says you run transaction monitoring every hour, but your system doesn’t support that, the regulator will notice.

When your company structure, finances, platform, and compliance framework are fully prepared, the process moves faster and with fewer surprises. The jurisdictions you choose, the documents you submit, and the people you appoint all directly influence timelines, costs, and the level of trust from banks, PSPs, affiliates, and regulators. A well-planned licensing strategy gives you a clean launch and a stable foundation for growth in any market you target.