One day you’re scaling up, raising capital, and planning new markets — next day the government pulls the plug. Ask operators in Cambodia who watched their online businesses vanish overnight in 2019, or founders in India now scrambling after a $23-billion real-money gaming industry was suddenly outlawed in 2025. Years of product development, marketing spend, and compliance budgets gone in a single announcement. That’s the brutal reality of gambling regulation: you can get blindsided.

This article is your field guide to avoiding that fate. We’ll walk through the top online gambling legal countries in 2025 — what a licence costs in time and money, how taxes and payment rails really work, and which markets are stable enough to bet your business on. If you’re deciding where to launch or expand, this is the practical map you want open on your desk.

What Changed in Gambling Laws in 2025

Looks like 2024 was the year of "wait and see," but 2025 is shaping up to be the year when regulators finally took action. All over the world, governments are either hitting the brakes on online gambling, or finally creating a clear licensing framework after years of operating in a grey area. For operators and investors, this means the rules of the game have shifted again, sometimes overnight.

India: The Big Ban

In August 2025, India passed the Promotion and Regulation of Online Gaming Act. Overnight, every real-money game,such as poker, rummy, fantasy sports, was outlawed. Platforms like Dream11 and MPL froze operations, investors saw billions in value evaporate, and advertisers pulled campaigns. For operators, it was a textbook example of how a booming $23B industry can vanish in one vote.

New Zealand: Opening the Door

While India slammed it shut, New Zealand opened one. In July, Parliament advanced a bill to license up to 15 online casino operators. For the first time, there's a regulated path in a market previously dominated by offshore sites. The bill includes strict consumer protections, bans unlicensed advertising, and gives operators until 2026 to apply for a license.

Brazil: Mass Site Blocks

Brazil began blocking thousands of unlicensed gambling sites in 2025 as part of its regulatory crackdown. Licensed operators suddenly look safer, while grey-market players are losing access to local users. For companies eyeing Brazil’s fast-growing market, the message is clear: comply, or disappear.

United States: Same Patchwork, More Costs

In the US, changes came through tax tweaks and state-by-state moves:

- Maryland raised its sports betting tax from 15% to 20%.

- Illinois added a per-bet tax that squeezes high-volume sportsbooks.

- A federal reform capped gambling loss deductions at 90% starting 2026, which is a hit to high-roller economics.

- States like Ohio, Maryland, and Virginia are debating the legalization of online casinos, but the costs of entry keep climbing.

The US remains the biggest prize, but margins are thinner and compliance is heavier.

Italy: The €7 Million Ticket

Italy introduced a new nine-year licensing system in 2025. The price of admission: around €7 million per license plus a 3% annual tax on net revenue. The effect? Smaller operators are locked out, and consolidation is likely as only deep-pocketed brands can play.

Spain: Ads Under Lockdown

Spain tightened its advertising rules: celebrity and influencer endorsements are out, and stricter content standards apply. Marketing now has to shift to compliant channels, forcing operators to get more creative and less visible.

2025 became a year of contrasting decisions in online gambling regulation: India’s outright ban and New Zealand’s cautious legalization; Brazil’s enforcement wave and Italy’s massive license fees; the US squeezing taxes and Europe layering on digital compliance.

For operators, the lesson is blunt:

- Booming today can mean being banned tomorrow.

- New opportunities come with steep costs.

- Margins everywhere are under pressure.

This is why tracking regulation isn’t optional! It's the difference between scaling safely and waking up blocked.

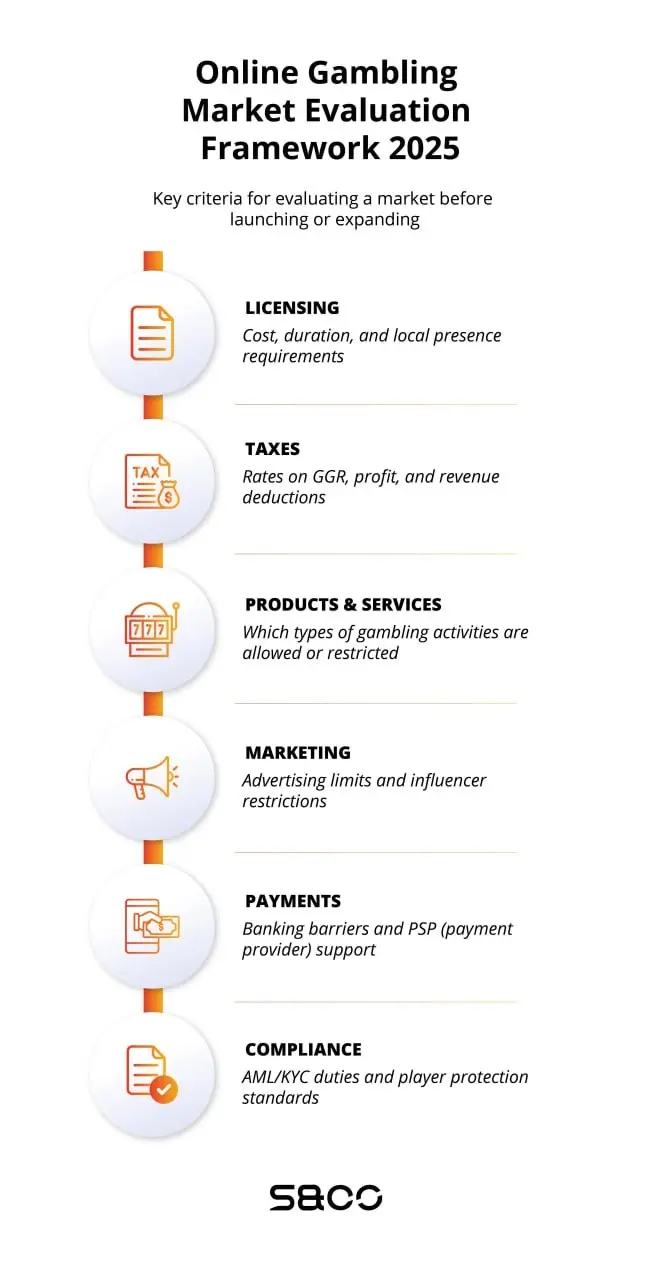

Key Criteria for Evaluating a Market in 2025

Before you choose where to launch or expand, you need a clear framework. Just asking “Is it legal?” isn't enough. You need to know how difficult, how expensive, and how sustainable it will actually be to run a business there. Here are the criteria that matter most in 2025.

Licensing Costs & Requirements

The licensing process goes far beyond a simple approval. It’s a complex journey that demands your time, money, and a commitment to being present in the market.

- Italy: each licence now costs ~€7 million upfront plus annual fees and taxes. That figure alone knocks out smaller operators and forces market consolidation.

- New Zealand: proposes 15 licences only, with strict eligibility tests. This scarcity makes the market attractive, but it is also highly competitive.

- US States: in Pennsylvania, a licence for online casinos can run $4 million per vertical (poker, slots, tables separately). Multiply that across multiple states, and compliance teams are stretched thin.

Our advice is as follows: Don’t just ask, “Can I get licensed?” Ask whether the licence is worth the price tag compared to market size.

Taxation & Revenue Share

Tax rates directly shape margins. A market that looks profitable on paper can turn red once taxes kick in.

- Maryland: raised sports betting tax from 15% to 20%, a sudden 5% hit to operators.

- Illinois: added a per-bet tax (25 cents on the first 20M online bets), targeting high-volume sportsbooks.

- Spain & Other EU States: Multiple countries nudged up GGR tax rates in 2025. Even a 1–2% increase can wipe millions off EBITDA for large operators.

You should always model after-tax profitability, not just topline projections.

Product Restrictions

Not every licence covers every game. Some regulators carve up the market by vertical.

- India: outlawed all real-money games, including fantasy sports once considered “skill-based.”

- UK: strict oversight continues — credit cards for gambling remain banned, and new affordability checks are under discussion.

- Germany: Online slots are capped at a maximum stake of €1 per spin, which throttles ARPU compared to markets with no such cap.

It is crucial to know which verticals are allowed, and whether the limits kill your unit economics.

Advertising & Marketing Rules

Even if you can operate, can you actually reach your customers?

- Spain: celebrity and influencer endorsements banned. Operators must stick to plain, tightly controlled ads.

- Italy: advertising remains restricted to certain channels, complicating customer acquisition.

- Brazil: new enforcement includes blocking unlicensed sites and cracking down on unregulated advertising campaigns.

If acquisition channels are locked down, factor in higher CPA and consider local affiliate networks or partnerships.

Payments & Banking Infrastructure

Payment rails are the oxygen of online gambling. Without them, even a legal operator can suffocate.

- India: with the ban, payment providers were ordered to freeze transactions linked to real-money games. Wallets emptied, withdrawals delayed, reputations hit.

- US: some states ban credit cards for deposits. Operators must offer ACH, e-wallets, or prepaid solutions.

- Europe: AML/KYC rules under the EU’s 6th AML Directive are tightening. Expect stricter source-of-funds checks.

We recommend testing whether local banks and PSPs are friendly to gaming transactions before committing.

Compliance & Player Protection

Governments increasingly judge operators not just on legality, but on social responsibility.

- UK: record fines like William Hill’s £19.2m for AML and responsible gaming failures show regulators have teeth.

- EU: Digital Services Act and AI Act introduce new obligations regarding transparency, recommendation systems, and user safety. They are not gambling-specific, but binding on operators.

- Brazil: Enforcement agencies are linking gambling regulation to anti-fraud and consumer protection, forcing platforms to enhance their monitoring capabilities.

Build compliance into your unit economics: the cost of AML checks, age verification, and safer-gambling tools should be calculated per customer, just as you measure CAC or LTV.

The Checklist: Ask Before Entering Any Market

- Licence: what’s the cost, duration, and local presence requirement?

- Taxes: what % of GGR or profit will I actually keep?

- Products: which games are allowed, and are there caps or restrictions?

- Marketing: can I advertise effectively, or are channels restricted?

- Payments: do banks and PSPs support gambling in this market?

- Compliance: what are the AML/KYC and player protection expectations?

Top 5 Stable Markets to Enter in 2025

Choosing where to expand in 2025 is about striking a balance between stability, cost, and potential upside. Here are five markets that currently offer the most attractive mix.

United Kingdom — the Gold Standard

The UK Gambling Commission is one of the strictest regulators in the world, but that’s exactly why the market is attractive: no surprises, no sudden bans. If you obtain a license here, banks and PSPs will treat you as legitimate, and partnerships will be easier to secure.

- Why it works: stability, high consumer demand, trusted payment rails.

- The pain point: affordability checks mean compliance budgets rise every year, and margins are thinner.

- Who should enter: well-capitalized operators who want a long-term anchor market and can invest in strong AML/KYC systems.

In short: The UK isn’t cheap, but it’s predictable.

Malta — the Gateway to Europe

Malta’s MGA licence remains the go-to for companies targeting multiple EU countries. It’s affordable compared to Italy or Spain, covers most verticals, and gives operators legitimacy in banking and partnerships.

- Why it works: lower licence costs, flexible marketing, and access to EU financial networks.

- The pain point: rising EU scrutiny means you can’t treat Malta as a loophole anymore, so expect full AML and DSA compliance.

- Who should enter: startups and mid-size operators using Malta as a base before scaling into larger EU markets.

In short, Malta still offers the best cost-to-reach ratio for Europe.

Brazil — the Growth Story

Brazil’s federal government finally moved from promises to action in 2025. Thousands of unlicensed sites were blocked, and licensed operators now have a clearer runway. With over 200 million people and a sports-mad culture, Brazil is one of the largest untapped regulated markets.

- Why it works: huge population, high demand, cultural affinity for betting.

- The pain point: compliance is strict, advertising is regulated, and licence fees are not small.

- Who should enter: operators with local partners, strong compliance teams, and the ability to localize payment solutions (PIX, local wallets).

In short: Brazil is no longer the Wild West, it’s the biggest growth play in Latin America.

New Zealand — the Newcomer

In July 2025, Parliament advanced a bill to issue up to 15 online casino licences. This is rare: a mature, developed country opening its doors to online gambling for the first time. Early movers will have the chance to shape consumer behavior and build market dominance.

- Why it works: a newly regulated market, low competition (15 licenses only), and high consumer trust.

- The pain point: strict consumer protection rules, heavy restrictions on unlicensed ads, and a small population.

- Who should enter: mid-sized operators who want a first-mover advantage and can handle a “clean” compliance environment.

In short: Small market, big first-mover advantage.

United States — the Giant Worth the Pain

The US remains the ultimate prize, offering high player value, a massive addressable market, and strong brand opportunities through sports leagues and casinos. But 2025 reminded everyone that margins are fragile: Maryland raised its tax to 20%, Illinois imposed per-bet fees, and federally, loss deductions are capped from 2026.

- Why it works: the most considerable long-term upside, proven appetite for online betting.

- The pain point: fragmented state-by-state laws, and sky-high license fees (e.g., $4M per vertical in Pennsylvania).

- Who should enter: operators with serious war chests, patient capital, and state-level lobbying resources.

In short: high stakes, high reward. If you can afford the entry cost, the US remains the biggest growth engine.

Offshore and Low-Regulation Jurisdictions

For years, offshore hubs promised operators a fast and cheap path into iGaming. However, in 2025, several high-profile cases demonstrated that what appears to be an easy entry point can quickly become a liability.

Curacao: Reform and Reputational Pressure

Curacao has long been the most popular offshore jurisdiction thanks to sub-licensing that costs just a few tens of thousands of euros per year. But in recent years, regulators have been under heavy international pressure to reform.

In 2024, the BC.GAME case exposed flaws in the sub-licensing system, with accusations of fraud and weak oversight making headlines. European courts even allowed critics to describe Curacao’s sub-licensing model as illegal. As a result, payment providers and banks have become far more reluctant to work with Curacao-licensed businesses. What was once the cheapest license in the industry now comes with a stigma that can cut operators off from critical financial rails.

Philippines: The POGO Crackdown

The Philippine Offshore Gaming Operator (POGO) scheme was once a booming hub for Asia-facing iGaming. But by late 2024, the Philippine government reversed course: new licences were banned, existing ones were not renewed, and police raids exposed links to fraud, illegal employment, and even human trafficking.

By 2025, the government had made it clear that POGOs are no longer welcome. Operators who had invested heavily in infrastructure and staff suddenly found themselves without a legal base. For many, the cost of exit outweighed the years of cheap licensing.

The United States has been particularly aggressive in going after offshore operators. In April 2025, the Michigan Gaming Control Board issued cease-and-desist letters to 13 unlicensed offshore websites targeting US players. At the same time, a coalition of state Attorneys General formally called on the US Department of Justice to crack down on the estimated $400 billion illegal offshore gambling industry.

The message was unambiguous: even if your licence is valid in Curacao, Antigua, or elsewhere, it does not protect you from enforcement if you target regulated markets like the US.

Offshore jurisdictions still exist, but the risks in 2025 are far clearer than before:

- Banking barriers: more PSPs and banks refuse to process payments from operators licensed only offshore.

- Domain blocks: regulators in Europe and the US actively block unlicensed websites.

- Reputational damage: investors and affiliates increasingly avoid operators with “weak” licences.

- Regulatory whiplash: as the Philippines showed, a government can simply shut the door, leaving operators stranded.

If there’s one truth in 2025, it’s that gambling regulation is totally unpredictable. India banned a $ 23 billion industry overnight, Italy raised the bar to a whopping €7 million per license, Spain clipped the wings of marketing, and the US continues to bleed operators with taxes. Meanwhile, Brazil is finally offering a regulated runway, New Zealand is cautiously opening up, and the UK and Malta remain steady anchors.

The lesson isn't just to "avoid risk", it's to measure risk the same way you’d measure CAC, LTV, or ROI. Market entry isn't about chasing headlines. It’s about aligning a jurisdiction with your business model, your capital, and your long-term growth plans.

- If you need stability and reliable banking, go where regulation is strict but predictable (UK, Malta).

- If you’re chasing growth, Brazil and New Zealand offer significant upside, but only with a solid compliance team in place.

- If you want scale, the US is still the ultimate prize, but the costs have to fit your funding model.

And yeah, even "lighter-touch" jurisdictions can play a role, but only as a strategic choice with the risks clearly priced into your plan, not as a shortcut to skip compliance.

In other words: treat every license decision like a business investment. Don’t just ask, "Is it legal?" Instead, ask, "Do this market's cost, risk, and stability align with our goals?" In 2025, that's the difference between building a brand that scales and creating one that disappears overnight.