Your digital agency drives results with affiliate marketing, but success depends on navigating the Federal Trade Commission's rules correctly. The FTC insists on compliance across all aspects – covering everything from clear disclosures to truthful advertising claims and proper endorsement practices. Getting this wrong creates real business risks: significant fines and damage to the reputation of your clients and your agency itself.

As a law firm focused on digital advertising compliance, we know these challenges. This article provides the practical information your agency needs to know to manage FTC affiliate marketing compliance successfully and protect your business.

Why This Matters: Understanding the FTC's Role in Affiliate Marketing

For digital agencies running affiliate marketing campaigns, the FTC is a chief referee ensuring fair play in advertising. FTC’s task is straightforward: protect consumers from deceptive or unfair business practices and foster fair competition.

The FTC views most affiliate marketing activities as endorsements. When an affiliate promotes a product or service and stands to earn a commission or receive any benefit if a consumer makes a purchase through their link, the FTC considers that promotion an endorsement. Why? Because that payment relationship could influence what the affiliate says and how they say it. The key principle here is transparency: consumers have the right to know when someone promoting a product has a financial motivation, as it helps them evaluate the credibility of the recommendation.

For example, in June 2024, the FTC settled a case with Taylor Welch, Christopher Evans, and their company, Traffic and Funnels. They were ordered to pay $1 million and were banned from making false claims about how much money people could earn.

So, what prompted this action? Traffic and Funnels sold high-priced business coaching programs, promising clients pathways to achieve significant financial success. According to the FTC, their marketing campaigns, often amplified through affiliate channels, were built around impressive claims of massive earnings potential.

The main issue, the FTC alleged, was that these claims were misleading and lacked substantiation – they didn't reflect the typical results most customers achieved. This deceived consumers into paying thousands of dollars based on inflated hopes.

Affiliate marketing disclosure: The Foundation of Compliance

If there’s one thing you absolutely must do to comply with FTC rules in affiliate marketing, it’s making proper disclosures.

You need to know what qualifies as a connection before you can disclose it. The FTC defines a material connection as any relationship between the endorser (your client's affiliate) and the seller (your client) that might materially affect the weight or credibility consumers give the endorsement.

Think broader than just direct payment:

- Affiliate commissions: The most obvious connection – getting paid for sales or leads generated through their link.

- Free products or services: Receiving the product/service for free or at a significant discount for review or promotion.

- Other financial benefits: Store credit, contest entries, paid trips, performance bonuses.

- Business or family relationships: If the affiliate is an employee, owner, or family member of the client company.

- Early access: Getting pre-release access to a product or service.

All disclosures are obligated to be clear and conspicuous. This translates to them being difficult for consumers to overlook and simple to process.While there's no single magic formula, the FTC emphasizes these key characteristics:

- Prominence: Is the disclosure large enough, loud enough, or prominent enough for consumers to notice easily? It shouldn't be hidden in tiny print or whispered quickly.

- Presentation: Is the disclosure communicated in language ordinary consumers can understand? Avoid jargon, technical terms, or unclear abbreviations.

- Placement: Is the disclosure placed where consumers are likely to look or hear it in connection with the endorsement itself? It shouldn't require scrolling, clicking away, or hunting.

- Proximity: Is the disclosure close to the claim or affiliate link it relates to?

Evaluate disclosures from the perspective of a typical consumer encountering the content for the first time. If they could reasonably miss it or misunderstand it, it's likely not clear and conspicuous enough.

Placement Matters: Where Disclosures Must Appear

The context of the platform heavily influences effective placement.

- Websites/blog posts: Place the disclosure clearly and prominently at the top of the relevant post or page, before the main content and any affiliate links. Alternatively, place it directly adjacent to the specific affiliate link/recommendation if the context makes that clear. Relying solely on a site-wide footer or a separate "disclosures page" is not enough.

- Social media posts (Facebook, Instagram Feed, X/Twitter, LinkedIn): Include the disclosure at the beginning of the caption or post, ensuring it's visible before any "see more" or truncation point. Don't hide it within a dense block of hashtags at the end.

- Image-based content (Instagram Stories, Pinterest Pins, Snapchat): The disclosure must be superimposed directly on the image or video, in a clear font and with sufficient duration for viewers to read and comprehend it. If using swipe-up links, the disclosure should be visible before the user swipes.

- Video сontent (YouTube, TikTok, Instagram Reels): Disclosure should be included both visually and audibly within the video content, ideally near the beginning and potentially repeated if the video is long or the endorsement comes later. Relying solely on text in the video description box is usually inadequate as many viewers don't read descriptions.

- Emails: Integrate the disclosure clearly within the body of the email, close to the relevant recommendation or affiliate link.

- Live Streams: Disclose periodically during the stream, both verbally and through clear, persistent on-screen text.

Common Disclosure Mistakes to Avoid

Train your team and advise clients to steer clear of these frequent errors:

- Using vague or unfamiliar terms.

- Placing disclosures only on profile/bio pages or site footers.

- Hiding disclosures below the "more" fold or deep in hashtag clouds.

- Making disclosures too small, too fast, or otherwise easily missed.

- Inconsistent application across different posts or platforms.

- Forgetting to disclose non-monetary material connections (like free products).

- Assuming platform-specific tools alone satisfy FTC requirements.

Beyond Disclosure: Ensuring Truthful Advertising and Claims

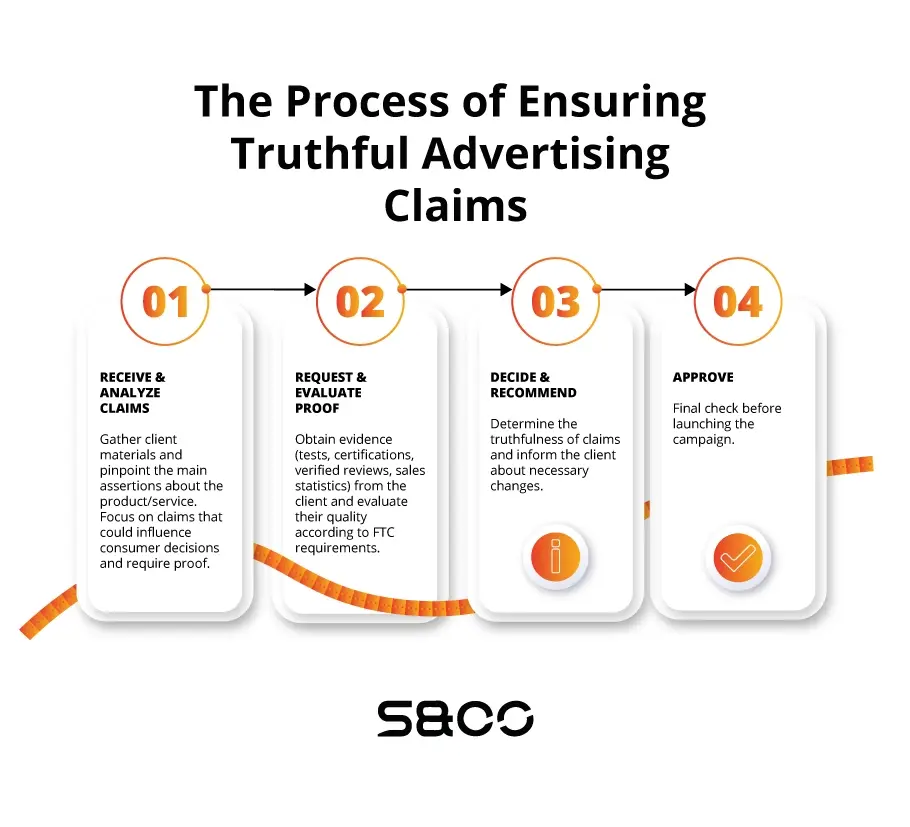

While clear disclosure is fundamental, it's only half the battle for FTC compliance. The main message promoted through affiliate channels must also be truthful, non-deceptive, and provable. As an agency managing these campaigns, ensuring the substance of the advertising holds up under scrutiny is just as important as checking the format of a disclosure hashtag. The FTC prohibits unfair or deceptive acts or practices, and this applies squarely to the claims made in your clients' affiliate marketing.

Don't Mislead Consumers

The FTC sees an ad as deceptive if it says something false—or leaves out something important—that could mislead a reasonable person and affect their decision to buy.

For agencies, this means vetting the main message. Is the product's effectiveness being overstated? Are benefits being misrepresented? Is the overall impression given by the affiliate's content truthful?

As an example, Credit Karma allegedly used "dark patterns" and told users they were pre-approved or had high odds for credit cards, misleading many who didn't actually qualify. The FTC charged this was deceptive, wasting consumers' time and potentially hurting their credit when denied after applying.

In a January 2023 settlement, Credit Karma agreed to pay $3 million for consumer redress and was ordered to stop these misleading tactics and false assurances of approval.

The FTC targets deceptive financial offers and "dark patterns," requiring truthful claims about eligibility. Misleading consumers about approval odds can lead to multi-million dollar consequences.

Advertisers must have a reasonable basis for any objective claim about their product or service before the claim is made public. The level of proof required depends on the claim:

- General claims: Require reliable evidence supporting the specific message conveyed.

- Health and safety claims: Demand competent and reliable scientific evidence, which often means high-quality human clinical trials for health-related benefits (like weight loss, disease treatment, etc.).

- Performance claims: Need testing or evidence showing the product performs as advertised under normal use.

- Earnings claims: Must be backed by evidence proving the claimed earnings are representative of what typical consumers can generally expect to achieve.

This applies to claims made by affiliates promoting your client's product. Your agency should understand these standards, advise clients accordingly, and potentially request substantiation documentation from clients for key claims being promoted.

Sometimes agencies use the disclaimers: "Results not typical," "Individual results may vary". The FTC generally considers such disclaimers insufficient to cure an otherwise misleading claim. If an affiliate highlights extraordinary results, simply saying "results not typical" doesn't fix the problem if that extraordinary outcome is, in fact, not typical. The overall impression must still be truthful. Ads featuring testimonials with non-typical results should clearly communicate what consumers can generally expect. Relying on fine-print disclaimers is a risky compliance strategy.

Influencer Marketing Compliance: More Than Just #ad

Working with influencers and creators goes far beyond just ensuring they add #ad or #sponsored. Influencers cannot make claims about a product or service that the advertiser cannot substantiate. They can share their honest opinions, but objective claims must be truthful and provable.

So, agency responsibilities in this field often include:

- Vetting: Choosing influencers whose audience is appropriate and who have a track record of responsible engagement (including compliance).

- Clear contracts: Agreements should explicitly outline FTC compliance requirements regarding disclosure, truthful claims, and potentially content approval processes.

- Guidance: Providing influencers with clear instructions on acceptable disclosure methods (wording, placement) and specific dos and don'ts for talking about the client's product/service. Don't assume they know the rules.

- Monitoring: Implementing a reasonable process to monitor influencer content for compliance.

In August 2024, the FTC sued Total Wealth Academy, a real estate training company, its owner, and several social media influencers who promoted it.

The FTC alleged TWA used deceptive and unsubstantiated earnings claims, and that these influencers amplified those misleading messages to their followers.

The case is ongoing, but the FTC's decision to sue the influencers themselves sends a clear warning: even influencers can be held legally liable for the deceptive advertising claims they repeat, especially about potential earnings.

Handling Customer Reviews and Testimonials Ethically

While authentic customer voices carry immense weight, the FTC rules strictly forbids distorting that reality through manipulated reviews or testimonials.

Practices explicitly prohibited by the FTC include:

- Posting fake reviews written by employees/affiliates posing as customers, or purchased from review brokers. For example, in August 2023, Roomster, a rental listing platform, got busted by the FTC and several states for using fake reviews and sketchy rental listings to lure people. The company bought over 20,000 glowing reviews to make their app look legit. The business agreed to pay $1.6 million over the deceptive practices.

- Unjustifiably suppressing negative reviews to present a misleadingly positive average. Fashion Nova got caught automatically hiding customer reviews that were rated less than four stars, basically burying the negative feedback. The FTC said this tricked shoppers by only showing the good stuff, hitting them with a $4.2 million penalty in a 2022 settlement and ordering them to post all relevant reviews.

- Editing reviews in a way that changes their meaning.

If a business offers customers anything of value (a discount, free product, gift card, contest entry) in exchange for providing a review, that incentive must be clearly and conspicuously disclosed within or alongside the review. Car shipper AmeriFreight offered $50 off for customers but didn't clearly disclose the deal. The FTC took action, hitting them with a $50k fine in a settlement and mandating disclosure of incentives.

When Can Your Agency Be Held Responsible?

As a digital agency managing affiliate marketing campaigns, it may seem like affiliate rules violation is solely the client's responsibility. However, that assumption can be risky. The FTC can hold advertising agencies accountable for deceptive or unfair marketing practices under Section 5 of the FTC Act, especially when the agency is involved in creating or running the problematic campaigns. Just look at the Marketing Architects case, where an ad agency paid $2 million related to its role in creating ads for weight-loss products that featured false claims and made-up testimonials.

FTC liability for agencies often hinges on the degree of participation in the deceptive conduct and the agency's knowledge. Your agency's risk increases if you:

- Create or develop deceptive content: Directly writing ad copy, designing creatives, or developing campaign strategies that contain misleading claims or omit material facts.

- Disseminate deceptive ads: Placing or running ads that you knew or should have known were deceptive or lacked adequate substantiation.

- Know (or should have known) about deception: Ignoring obvious red flags, such as outlandish claims provided by the client, affiliates making clearly unsubstantiated promises, or consistently poor disclosure practices within campaigns you manage. Willful blindness isn't a defense.

- Fail in oversight: Lacking reasonable monitoring procedures for affiliate or influencer content created under campaigns you administer, allowing non-compliant material to proliferate.

While all FTC rules apply, agencies should be particularly vigilant about disclosure failures, unsubstantiated claims, and improper endorsements. Proactive compliance is the best defense. Consider implementing contracts:

- Client agreements: Clearly define the Agency's role as a neutral service provider facilitating the Advertiser-Publisher relationship. Include representations and warranties from the client regarding claim substantiation and product legality.

- Affiliate/influencer agreements: Ensure agreements used by you or your client require adherence to FTC guidelines (disclosure, truthfulness) as a condition of participation.

Moreover we advise you to conduct reasonable due diligence on new clients and the products/services being promoted. It would be good to ensure your teams, and anyone involved in affiliate marketing understand current FTC requirements. We propose our clients to develop internal checklists and workflows for reviewing ad creatives, claims, and disclosure practices before campaigns launch and periodically thereafter.

Your agency needs to implement a reasonable process for monitoring affiliate and influencer activities related to your clients' campaigns. This might involve spot checks, using monitoring tools, or requiring affiliates to submit certain creative materials for review.

Managing affiliate marketing programs offers significant opportunities, but it comes with inherent compliance responsibilities for your agency. Understanding the potential for agency liability under FTC rules and implementing proactive risk mitigation strategies are essential steps in protecting your business, maintaining your reputation, and fostering sustainable, compliant growth for both your agency and your clients.