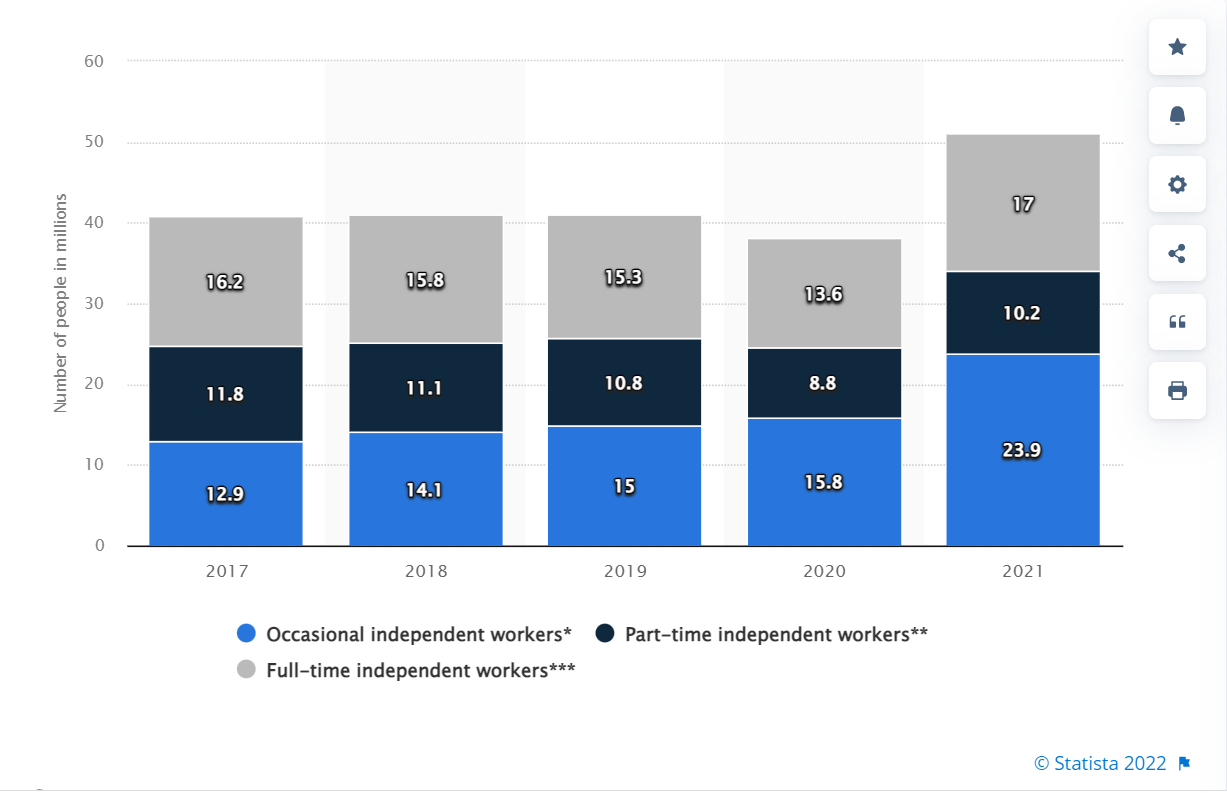

In 2021, there were approximately 23.9 million independent workers in the United States. This is 12.9 million more than in 2017. Google, Facebook, Amazon, Uber and other Silicon Valley tech giants are hiring thousands of independent contractors around the world. According to the New York Times, in March 2019, Google was working with 121,000 contractors worldwide, while there were only 102,000 full-time employees.

In 2027, 86.5 million people are projected to freelance in the United States, or 50.9% of the total workforce.

The growth in the number of independent contractors has also affected the IT business. OnContracting estimates that a technology company can save an average of $100,000 per year per US job by using a contractor instead of a full-time employee. However, such a company bears the risk of receiving fines from the Internal Revenue Service or the Department of Labor and state unemployment offices. Therefore, let's figure out what is an independent contractor agreement and how to draw up an agreement with an independent contractor in order to reduce risks.

Independent Contractor (Self-Employed) or Employee?

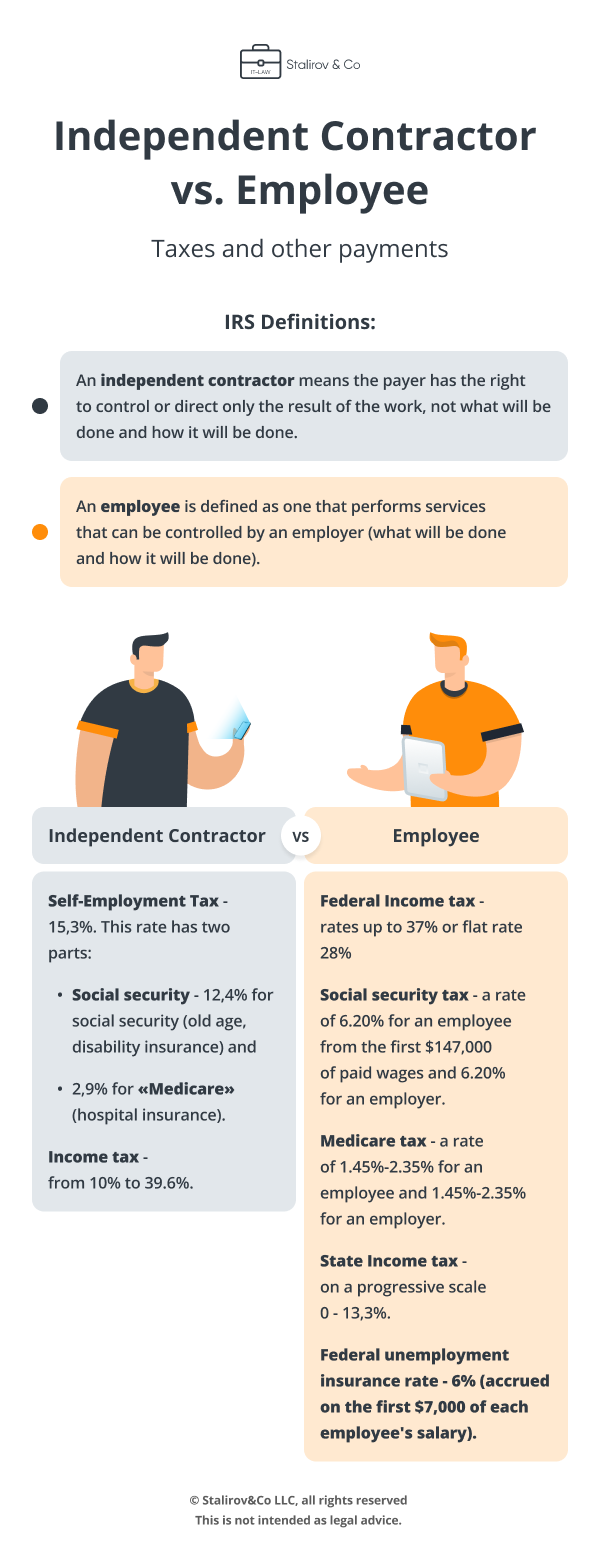

First, let's calculate taxes and other payments.

Tax deductions are available for independent contractors. You can deduct half of the self-employment tax from income tax. For example, if SE Schedule (application for calculating tax owed on self-employment net income) states that an independent contractor must pay a self-employment tax of $2,000 per year, it must be paid, but at the time of taxation, $1,000 will be deducted from your 1040 (Form 1040 is used by US taxpayers to file their annual tax return). You can also take advantage of the qualified business income deduction and receive an income tax deduction of up to 20% of your net self-employed income. Qualifying business income is defined as "the net sum of the qualifying items of income, gains, deductions and losses in respect of any trade or business". In a broad sense, this means the net profit of the business. For example, if your total taxable income (business income + any other income) is $170,050 or less, the independent contractor may qualify for a 20% deduction from your taxable business income.

There are other deductions: home office, health insurance, continuing education, car expenses, business insurance, and others.

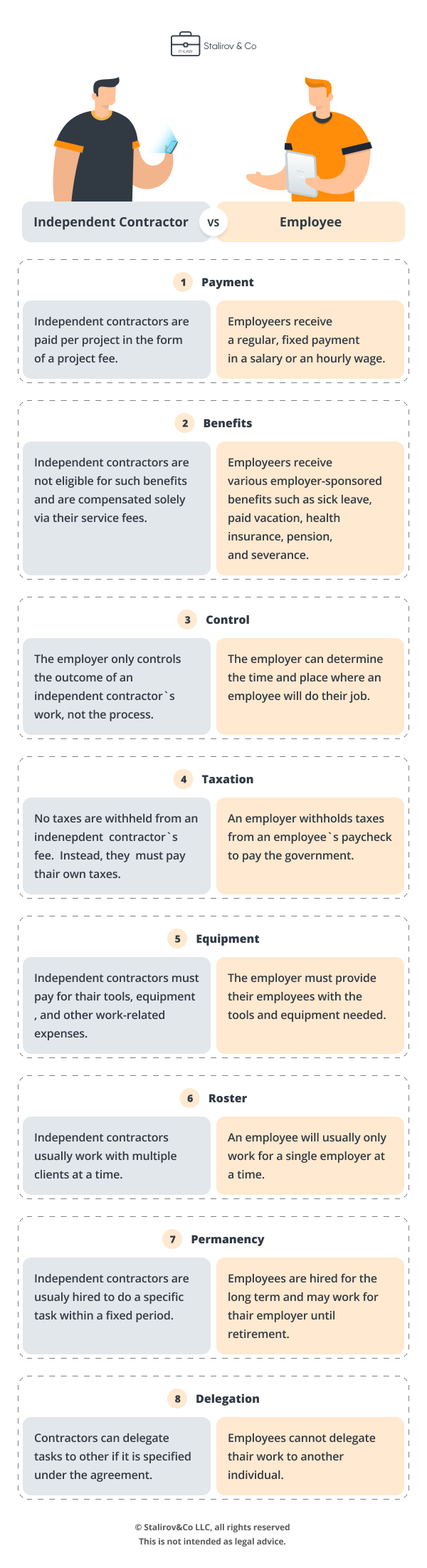

Working with an independent contractor in the United States has some benefits, such as it is more profitable than entering into employment contracts. Nevertheless, misclassifying workers as independent contractors can result in a fine of up to $500,000. Therefore, the contract should describe the workflow of an IT specialist as a self-employed person. So you can distinguish between labor relations and work with a contractor. Stalirov&Co IT lawyers have compiled a list of criteria you can use to define the difference.

An independent contractor agreement will help you avoid disputes with the Internal Revenue Service, Department of Labor and state unemployment offices. The points that you describe in the contract will apply to the organization of the workflow and help resolve conflicts in the team.

9 mandatory clauses of an agreement with an independent contractor

Stalirov&Co lawyer explains how to write a contractor agreement and what clauses should be included.

Definition of the subject of the contract - what services does the contractor provide?

The The IT lawyer’s purpose is to determine the list of services in the contract, and in the terms of reference, specific tasks and requirements for their implementation. General terms should be avoided. We propose to define the subject of the contract as follows: the contractor provides services for the development, modification, testing and technical support of software.

For business analytic it can be written like that: contractor undertakes to provide the following services:

- market research;

- management, strategic and operational planning;

- information services, including: searching and analyzing information.

Write a disclaimer stating that the services listed in the first paragraph of the contract are not exhaustive. A detailed description of the work can be agreed by the parties by specifying and detailing in the terms of reference.

Moreover you can add a list of business analytics functional obligations. For example the specialist to provide services and compliance with the terms of this agreement shall:

- create and develop Ecommerce products, affiliate programs: develop communication processes, form USP (Unique Selling Proposition) for partners;

- explore, connect and build relationships with new partners;

- develop creative ways to identify potential partners;

- optimize and scale work with existing partners;

- inform partners about new products;

- monitors the activity of the customer's partners;

- analyze the efficiency of the customer's employees;

- fulfill support functions in the field of marketing and advertising procurement for the correct work of employees;

- recommend ways to increase the income of the customer and partner organizations;

- bring in recommendations to increase the customer's income;

- analyze the partnership contract, with the relevant companies;

- enter into contracts with new affiliates or renew existing agreements with existing partners of the customer's;

- develop and implement new working strategies;

- analyze demographic data and statistics to identify emerging markets and opportunities for new products or services;

- monitor partner websites for fraudulent activity or policy violations, such as spamming or publishing confidential information.

They also prescribe a clause on the territory for the provision of services: the contractor provides services to the customer in the following territory: Canada, the United States of America. Such a clause affects the distribution of substance and taxation.

You should add crucial clarifications for this chapter:

- During the performance of this agreement the specialist acts as an independent contractor and in no case can be considered as an employee of the сustomer or as its agent or representative, and is not subject to internal labor regulations.

- The specialist provides services at his own risk and independently organizes its provision, including using his own tools and materials. In this case, if necessary, the customer may provide the specialist with access to its networks, cloud storage, etc.

- Each party shall be solely responsible for the accuracy of accounting and tax accounting, and neither party shall act as the tax agent of the other party under this agreement. Therefore, the specialist shall be solely responsible for the accuracy of accounting, tax accounting, as well as for the timeliness and completeness of payment of taxes and necessary payments to be made upon the receipt of the remuneration.

Such clauses in the contract confirm the independent status of the developer.

Work management - where are the tasks set and how are the results accepted?

To avoid chaos while arranging work, it is important to determine:

- communication channels: instant messengers, task managers, services, domain corporate mail and others;

- the customer's ability to cancel the task or detail its description: change the conditions or deadlines;

- procedure for accepting the results of work.

It is important to distinguish between which defects the developer fixes for free, and which will be considered an additional work.

It is not always easy to distinguish between error and revision. For example, a client left a voluminous review on the site. After that, the button for scrolling through the reviews moved out. The bug in the work arose due to adaptive layout. But changes to the content on the site should be displayed correctly, which means the developer made a mistake.

And now an example of a bug, the elimination of which will have to be paid extra. In the contacts section of the sites, Google maps are wired. Previously, developers added such functionality to the site by copying a piece of code. But recently, Google has introduced a fee for hosting Google Maps. After that, the pages of sites with maps gave an error. But it's not the developer's fault. To solve the problem, you need to buy the right to place a Google map on the site, and make changes to the code.

Let's return to the procedure for accepting the results of the work. Be sure to set out in the contract the means of their transfer.

According to the results of the tasks performed, the contractor submits the results of the work in the form specified by the customer or using:

- email account;

- task manager: Jira, Trello;

- account in Confluence;

- Git repository Services: Figma.

The names of all task managers, systems and services are just examples. Your contract should specify real communication tools and channels, places for setting tasks, transferring intellectual property and confidential information that the contractor uses.

Cost of services and payment procedure - how much, how and when does an IT company pay an invoice?

In this section, we advise you to prescribe the technical terms of payment, which will not change:

- payment model: Fixed price or Time&Materials;

- payment method (SWIFT, SEPA);

- the procedure for issuing an invoice;

- taxation issues: which party, in which country pays taxes;

- the procedure for paying bank commissions;

- the procedure for agreeing and paying for "overtime";

- what is included in the cost of services / works, and what is paid separately;

- the procedure for compensation or payment for licenses, special equipment, etc.

Here are some examples of terms.

- The customer shall make monthly payments within 45 days after the end of the month and the specialist’s monthly compensation is paid bi-monthly.

- Payment for the services rendered shall be made on the basis of the fixed price model.

- There may be a clause in the contract about the payment of bonuses. For example, a customer pays the manager's Reward in the amount of 20% of net profit of the E-commerce division.

Intellectual property - what rights do IT companies transfer?

In the process of work, the contractor and other employees create the intellectual property items:

- trade/company names, trademarks/marks, trade secret, confidential information;

- concepts, ideas, methodologies;

- methods, analyses, algorithms, strategies, research, processes, other results of intellectual activity;

- software, digital or other computer files containing information, databases;

- other items that may be subject of intellectual property in accordance with the international legal instruments.

Specialists can use open libraries, or licensed IT solutions and technologies. It is important that the independent contractor does not infringe the copyrights of third parties. Therefore, add a clause to the contract stating that he is responsible for the legality of using the intellectual property object in the final product.

In order to establish IT Company’s ownership of intellectual property, write in the contract that all property rights to intellectual property objects are transferred to the customer from the moment of creation, which is confirmed by an invoice to international contracts.

Only in this case, the company will be able to transfer the finished IT product to the client. If you do not have a clear chain of transfer of rights from the developer to the customer, sooner or later this can become a problem.

In the case of an agreement with a developer, you can add a clause about licenses. Depending on the scope of the transferred rights, the legislation distinguishes between exclusive and non-exclusive types of licenses: the contractor provides, and the customer receives a non-exclusive license for the implementation of all objects of the contractor’s intellectual property rights created as part of the provision of services under the contract.

We also advise you to clarify exactly what rights are transferred to the customer from an independent contractor:

- modify, adapt, use in parts and otherwise change IT solutions without prior agreement with the contractor;

- generate derived objects;

- sell and transfer for use, issue licenses for an IT product;

- import and export objects of intellectual property;

- advertise IT products and other rights.

Now the California court is hearing the Rambler case against employee Igor Sysoev. In his spare time, the programmer created the Nginx IT solution, which was distributed as open source under a BSD family license. Later, the employee quit Rambler and registered Nginx in the British Virgin Islands and three other companies with the same name in the United States. That's just the Rambler Group claiming its rights to the Nginx software, as the software product was developed by former employees using the company's resources.

There is no final decision in the case, but one thing is clear: employees can be resourceful and unpredictable. This practice shows that we have to exert special care when dealing with sections on intellectual property so as not to lose IT solutions worth millions of dollars.

The final touch in the section on intellectual property is the point on how to transfer the results of work.

One of the possible ways is to provide access to the repository where the intellectual property object is located. But this is just an example. Your contract should describe the methods that independent contractors use. The company's task is to create a unified environment for work, communication and transfer of confidential information.

Confidentiality - what information should be kept secret?

The contractor knows everything and even more about the work of an IT company: project budgets, employee salaries, client lists, innovations, features, algorithms, approaches to work. Therefore, it is important to limit the employee's ability to disclose it. To do this, a confidentiality section - NDA - is included in the contract of an independent contractor.

The task of an IT lawyer is to describe in detail what kind of information is considered confidential: contracts, preliminary agreements, employee salaries, cost of services, project budgets, business proposals, customer data, business plans, marketing research, terms of reference, technological documentation, work progress reports. The list will differ in the contracts of different IT companies, as it takes into account the organization of internal processes and IT products that the team is working on.

Read more about how IT companies protect confidential information in the NDA article.

After the confidentiality regime is described, the rules are set, do not forget to prescribe sanctions - a fine and compensation.

NON-COMPETE Clause

During the term of an agreement and within 1 year afterwards the specialist undertakes not to:

- commit any actions with signs of enticement towards the customer and actions with signs of unfair competition;

- cooperate with any competitor;

- provide his services to the competitors of the customer;

- use the methods and means of providing his services to the competitors of the customer;

- invite the employees of the customer to enter into labor relations with the competitors;

- create, facilitate or in any way participate in the creation of a company or enterprise that will conduct a similar or competing business in relation to the business of the customer.

In case the specialist performs any actions having the signs of poaching, he shall be obliged to pay a penalty amounting to 100% of the remuneration.

In case, the specialist commits any actions with signs of unfair competition, he undertakes to pay, for each such action, a fine of 50 000 US dollars.

Processing of personal data

The independent contractor gains access to the customer's personal data. For example, name, last name, patronymic, telephone numbers, e-mail address, IP address, time zone, address data, access /use /authorization data in any system, contract data, financial and bank details, credit card number, signatures of persons and any other data that can be used to identify any person. Therefore, it is important to add clauses on the protection of personal data to the contract.

- The specialist undertakes to process personal data in accordance with the documented instructions of the customer.

- During the personal data processing, the specialist undertakes not to transfer access to personal data to anyone without prior permission from the customer for such transfer.

- The specialist undertakes to take all reasonable measures to protect personal data from unauthorized access by others, loss, illegal copying, distortion, loss, etc.

- In case of expiration of an agreement, or in case of its early termination, the specialist undertakes to return to the customer within 5 days all previously received personal data.

Moreover you should add terms about access ways. For example:

- by providing access to databases;

- by file transferring, e-mail, messengers, Slack, etc.;

- during negotiations with the customer or clients.

Conflict resolution - where will the dispute be considered?

The independent contractor's contract must include a dispute resolution clause.

Most disputes in IT are resolved through negotiations. Therefore, we advise you to provide for pre-trial settlement of the dispute in the contract.

Describe the algorithm of the negotiation procedure:

- Write and send a claim - the party whose rights and legitimate interests have been violated applies to the other party with a justified claim.

- The party that received the claim must respond, for example, within 30 calendar days.

- If there is no response to the claim, it is considered that the opponent has accepted the claims.

And only when it becomes clear that the negotiations did not lead to a solution to the conflict, the parties can apply to the court of the state where the defendant company is registered. In this case you need an IT attorney, who will represent the company's interests in court and prove the fact of contract violation.

The dispute may also be arbitrated. For example, International Commercial Arbitrations with their place of arbitration in Ontario.

Termination of the contract - how many days for sending a notice to the other party?

The contract is signed for an indefinite period or for a short period (up to a year) with auto-renewal. The latter option means that the contract continues to be valid after its expiration, if neither party has declared its termination before the expiration date.

The IT company and the contractor may initiate the termination of the contract. It is important to set the period of time to send a notice of their cooperation termination. For example, 30 days. The IT company will have time to find a replacement for the employee, and the contractor will have a new project.

In addition, the contract can be terminated through a supplementary agreement. You can set a period longer than the one the contract originally prescribed. IT lawyers use a supplementary agreement to secure an agreement between an IT company and a contractor about the latter staying on the project longer, for example, until a certain scope of work is completed.

It will not be superfluous to settle the consequences of the termination of the treaty as a whole. Such consequences include the obligation to transfer or destroy confidential information, return software or hardware, revoke access, and final settlement procedures.

Now you know what an independent contractor contract consists of and how to make a contract agreement effective. Of course, these are far from all the issues that are important to settle in an IT services agreement. There are still questions: jurisdiction, language of the contract, communication between the parties, details of the parties, and others. Operating situations may vary. Today an employee completes tasks on time and the team loves him, tomorrow he refuses to sign and hand over the results of work to you. In this case, if the contract describes in detail the product that the programmer developed for the customer, and the moment of transfer of intellectual property rights, a conflict with the contractor is not terrible. This is how you need to work out each contractual risk so that an IT company does not waste time on conflicts and creates IT products worth millions of dollars.

In order for an independent contractor agreement to be truly safe for an IT company, a lawyer needs to understand the specifics of services, the work of managers and take into account the described issues.